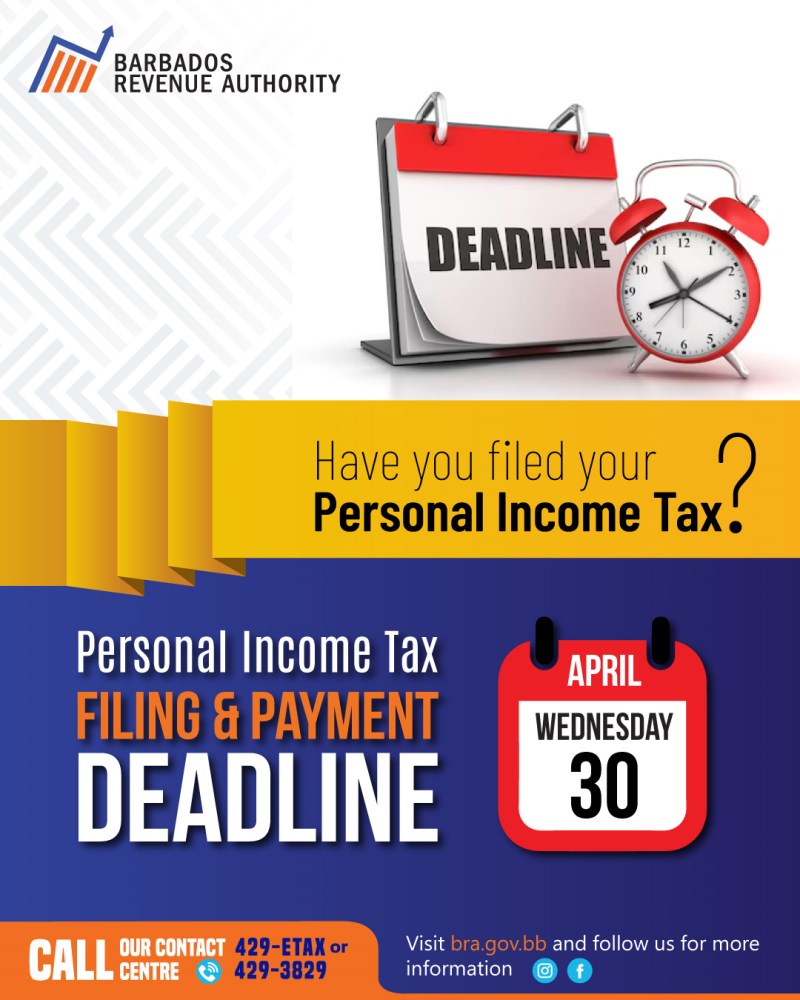

Personal Income Tax Filing Deadline Remains April 30

The Barbados Revenue Authority "the Authority" reminds all employees and pensioners who earned over $25,000 and $45,000, respectively in 2024, and all self-employed persons that the deadline for filing their 2024 Personal Income Tax (PIT) return is Wednesday, April 30, 2025. However, persons filing the 2024 Reverse Tax Credit $1300 claim have until December 31, 2026 to file.

Taxpayers should ensure their PIT returns are accurate and submitted on time to avoid penalties and interest. All returns should be filed online in TAMIS at https://tamis.bra.gov.bb.

The Authority currently has an ongoing tax clinic in the Queen's Park Steel Shed and Customer Service sites at Holetown Public Centre, Warrens Tower II and Bridge Street Mall to assist taxpayers in meeting this deadline. The Clinics will end on Friday, May 2, 2025.

"Our goal is to make the tax filing process as smooth and accessible as possible. Before filing, we encourage everyone to check their third-party information such as employment or pension income and have accurate banking details to hand if receiving a refund”, said Erica Lazare, Communications Officer with the Authority.

"For those filers who have to pay income tax, online payment can be made with a debit or credit Visa or MasterCard on the TAMIS website by going to the Account tab and selecting 'Make Payment' from the options list".

Lazare added that filers who made a mistake on a submitted return can edit that return by going to the Returns tab in TAMIS and selecting the 'Request Amendment' option. She further stated that persons with evidence of a genuine reason can request a filing extension before the deadline by going to the Returns tab and selecting the 'Request Extension' option.

For further assistance, persons may call the Contact Centre at 429-ETAX or 429-3829 and visit the Instagram or Facebook pages or website at bra.gov.bb.